Fees, Credits and Exemptions

Likely, the most common and important question that each and every customer of a potential stormwater utility will ask up front is …

“How much is this going to CO$T me?”

This webpage has been developed to provide those seeking to establish a stormwater utility (SWU) with guidance and additional information for developing rate structures and associated fees, credits, and exemptions, but the Department cannot determine the actual dollar amount of the fees or credits for any individual SWU nor which rate structure(s) should be used.

This webpage has been developed to provide those seeking to establish a stormwater utility (SWU) with guidance and additional information for developing rate structures and associated fees, credits, and exemptions, but the Department cannot determine the actual dollar amount of the fees or credits for any individual SWU nor which rate structure(s) should be used.

While there will be some inherent similarities between the SWUs established by the counties, municipalities, or authorities in New Jersey, each SWU and its fees will be uniquely tailored to each service area’s stormwater needs. Although the same overall approach applies for developing an individual, municipal SWU or a larger, more regional SWU, the economies of scale and the ability to address specific regional watershed issues will likely improve with the larger, more regional SWUs.

The types of entities that the Act allows to form SWUs is summarized on the SWU home page. These entities include a single municipality or municipal sewerage authority, a single county, as well as various county authorities, such as county sewerage, utilities, or improvement authorities.

And as further discussed under Establishing a Stormwater Utility, multiple rate structure options and multiple fee and credit options should be developed during the Comprehensive Feasibility study process. These options would then be associated with different Levels of Service (LOS) to be proposed by the SWU. The various stakeholders and customers would then be able to make more informed decisions about the formation of the SWU.

The information and examples regarding rate structures provided below focus on a few of the more common rate structures that are being used by existing stormwater utilities throughout the United States and Canada, but other rate structures may be acceptable, as long as they comply with all requirements of the Act.

REQUIREMENTS IN THE ACT FOR FEES, CREDITS AND EXEMPTIONS

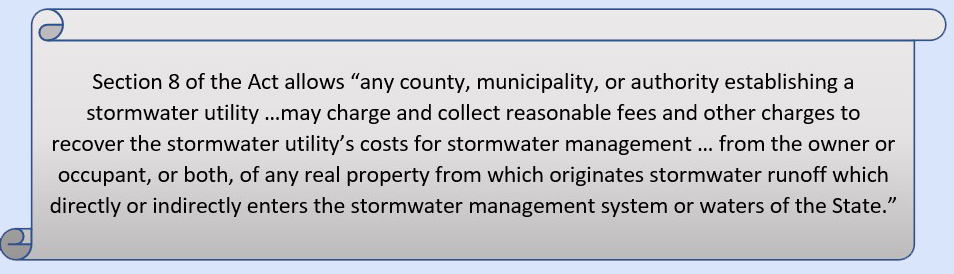

Section 8 of the Act includes certain requirements that any SWU in New Jersey must abide by when establishing fees and other charges, as well as when establishing applicable credits and exemptions. It is necessary for SWUs to understand these requirements prior to developing their rate structure. Below are the key points from the Act regarding fees, credits, and exemptions.

In other words, the fees and other charges must be based on a fair and equitable estimate of the stormwater runoff from the parcels within the service area, and cannot, for instance, be assessed one flat fee, or flat fees based on the type of property, such as residential or non-residential.

More detailed guidance is provided regarding these credits below.

It should be noted that only the portion of the property that has been granted the Farmland Assessment should be exempt from fees and other charges. The remaining land on the property should be assessed the appropriate stormwater utility fee according to that SWU’s rate structure.

In 1974, the first stormwater utility in the United States was established and fees were assessed for the services provided. Since then, numerous SWUs have been formed, resulting in the development and implementation of several rate structures for fee determination. In 2007, Western Kentucky University (WKU) started publishing an annual survey report that aims to identify as many SWUs as possible that have been established in the U.S. and Canada. As indicated in the 2020 Report, at least 1807 SWUs have been established in 40 States, the District of Columbia, and in Canada.

Appendix A of the WKU report tabulates the information on the existing SWUs, including their locations, populations, year established, rate structures and the monthly fees assessed. This report also contains links to many of these SWUs’ webpages which may be helpful to review for additional information. However, it is important to note that the rate structures identified in this table, and possibly other information, may not accurately reflect the type of rate structure that is currently implemented by some of those SWUs. These discrepancies are partly due to generalizations of the types of rate structures, and do not reflect the practiced implementation of these rate structures, as well as the commonly occurring practice of combining a simple rate structure for one type of properties, such as residential, with a more complex rate structure for non-residential properties. These discrepancies may also be the result of a change to the type of rate structure that was made after the utility’s information was incorporated into the survey. Also, while the fees that are charged by these SWUs can often be located up front on their websites, a deeper review of the description of the rate structures on those websites may be needed to determine which rate structure(s) were actually used as terminology is sometimes inconsistent.

In 2006, the National Association of Flood and Stormwater Management Agencies (NAFSMA) published the Guidance for Municipal Stormwater Funding, as part of a USEPA grant funded project, to provide a resource to local governments as they address contemporary stormwater program financing challenges. The guidance includes procedural, legal, and financial considerations in developing viable funding approaches, and provides a few example rate structure methods that were being used at that time.

Following this, the USEPA published a fact sheet in 2009 that provided a brief synopsis on a few different rate structures, including the ERU and the EHA. In the 2020 Stormwater Survey, WKU identified the ERU, Tiered, and the REF as the most common rate structures used by SWUs.

More information and one page summaries of the Tiered, ERU, EHA, and REF rate structures, as well as generic examples of the Tiered and ERU rate structures are included in the Rate Structure section below.

As noted above, the Act allows a stormwater utility to assess reasonable fees and other charges to recover their costs for stormwater management, but those fees and other charges must be based on fair and equitable approximations of the amount of stormwater runoff from the properties in their service area.”

The Act also allows the SWU to charge and collect these fees…

The SWU will need to specify in their rate structure whether the owners or tenants will be listed as the rate payers in the billing system. Additional discussion regarding the billing system can be found below under the Fifth Step.

The rate structures described below vary from assessing the same fee to all properties within specific ‘tiers’ of properties with similar sizes and characteristics; to more complex fee calculations based on precise, site-specific property information. The most commonly used property characteristic is impervious coverage, although the more complex calculations may incorporate additional property characteristic information such as soil types, slopes, etc. While the more complex rate structures tend to yield a more precise estimate of the runoff from each property, and therefore a more site-specific fee than a tiered approach, developing these more complex rate structures will incur much higher upfront costs and will require much more time and expertise to develop. These more complex rate structures will also require much more time to maintain each time individual properties throughout the service areas are modified. Each SWU will need to evaluate which of these rate structures, or combinations thereof, will be the most appropriate method for establishing fees for their organization and the service area.

Accordingly, the process of developing and establishing a SWU rate structure and fees is not something that should be rushed. The six steps listed below are typically involved in the development and implementation of a SWU rate structure and fee.

- Determining the overall costs of operating the SWU;

- Characterizing the service area;

- Developing a rate structure based on the approximate contribution of stormwater runoff generated from a property so as to assess fees in a fair and equitable manner;

- Creating a credit program to allow eligible customers to obtain partial fee reductions;

- Establishing a billing distribution method and cycle; and

- Follow-up review and assessment.

This first step involves determining the overall cost of operating the SWU. The Preliminary Feasibility Study will determine a portion of these costs by evaluating the current stormwater program’s expenditures. These current program costs will then be refined during the Comprehensive Feasibility Study, along with estimating the costs for the enhanced level of services to be provided by the SWU. In general, these costs should account for the immediate expenditures for regulatory compliance, resolving stormwater flooding problems, and the short-term expenditures regarding the initial establishment of an SWU, such as staffing, equipment, property, and administrative needs. Additionally, it is also important for the success of the SWU to factor the medium and long term goals, such as asset management program needs, capital improvements, and stormwater facility acquisition, into the development of the fees. The level of service established for the SWU will also have a significant influence in determining the short-term and long-term expenditures and resulting fees.

NOTE -If an SWU has a service area larger than a single municipality, an SWU service agreement will need to be developed between the SWU and the member municipalities. This should not be confused with the MS4 shared service agreement that would be required if the SWU were performing MS4 permit required tasks on behalf of the municipality(ies).

The second step involves characterizing the service area, which details the relevant characteristic land features of the properties in the service area, the most common of which are size and impervious area. While listed separately, this step could be performed at the same time that the existing costs are being determined in the preceding step. Utilizing this information, the SWU will be able to estimate the potential SWU fees.

First, the service area boundaries need to be delineated. All properties within this delineated area can then be initially considered as part of the customer base, though exemptions will be granted for appropriate agricultural and horticultural lands as specified in the Act.

Then it will be necessary to obtain property characteristic information, as noted above, such as property type (residential/non-residential) and size, separated by impervious and pervious areas. This data will need to be refined later when finalizing the rate structure and associated fees.

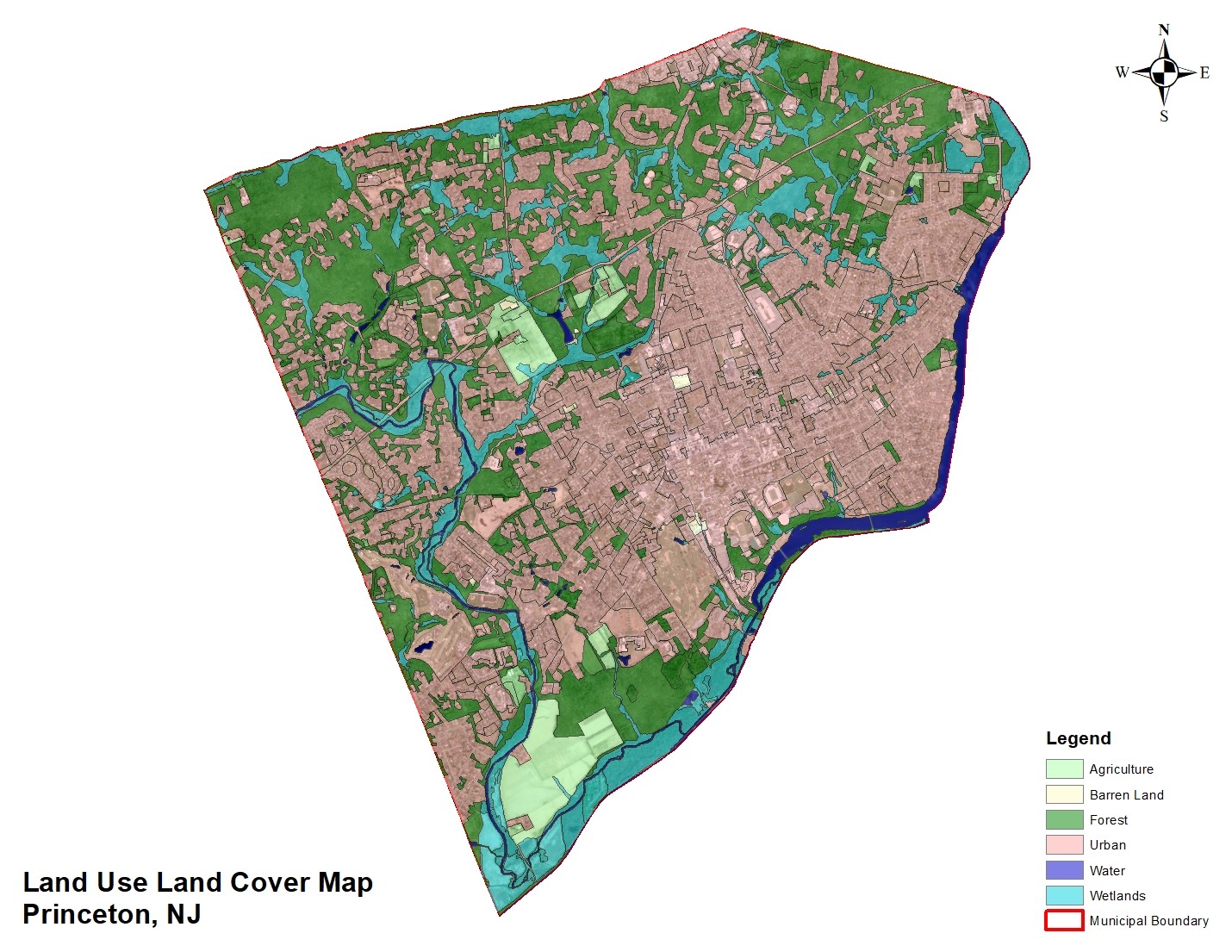

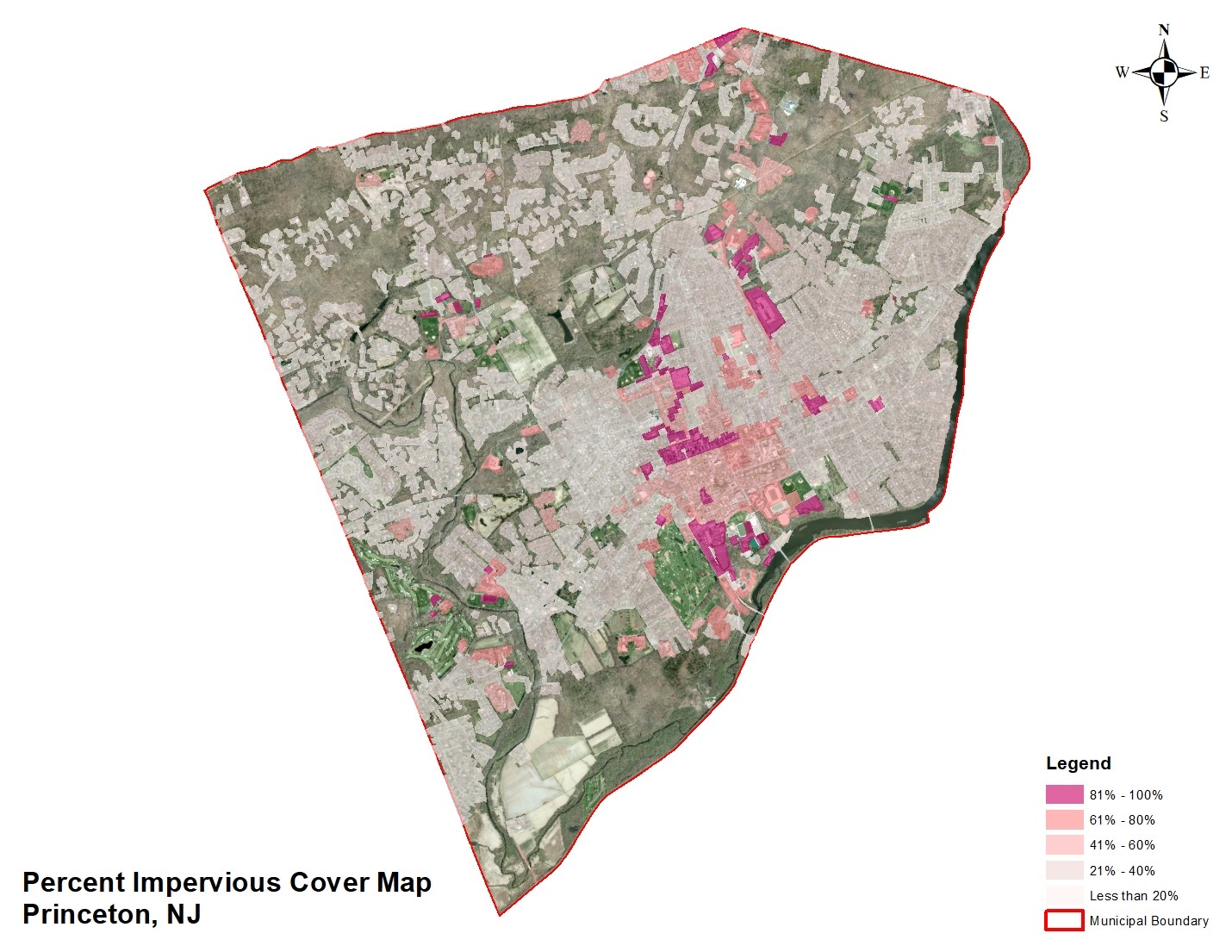

An analysis of property characteristics and impervious surfaces can be aided by the use of GIS data. The Department has made datasets and associated layers, such as land use and impervious cover, available on the NJDEP Open Data website. Examples of these datasets are shown below in Figures 1 and 2. Depending on which rate structure is chosen and how the SWU fee is determined, this information may or may not be detailed enough to assist in the fee calculation. The SWU may need to develop its own detailed analysis of land cover or impervious surfaces in its service area. Different types of detailed analysis, such as calculating the impervious surfaces in a service area from spectral imagery, can provide very accurate representations of impervious surfaces. An example of this method can be found here.

Estimating the potential SWU fee –

An initial estimate of the potential minimum SWU fee can be determined by distributing the estimated stormwater program expenditures to the residential and non-residential properties in the service area based on the amount of impervious area of each property.

**This initial estimate can be developed relatively easily by using the method described under the Equivalent Residential Unit (ERU)rate structure that is described below.

This initial estimate may be useful when presenting the SWU concept to top management to determine how forming an SWU will benefit the service area, as described in the “Engage Management” step on the Establishing a Stormwater Utility page.

The following example can be used to visualize a starting point to calculate a stormwater utility fee.

The stormwater utility will set a standard for the impervious area and equate it to ‘one equivalent residential unit’ (ERU). From this example value (e.g. 1,000 sq ft), the SWU will be able to assess each parcel and determine the fee per ERU. For this example, the stormwater utility has calculated that the fee for 1 ERU = $1.00 stormwater utility fee per month.

Once the SWU calculates the annual budget needed, they would compare how many properties are within the service area to that annual budget. The money needed to sustain the SWU annually will be used in order to determine the price per ERU (1 ERU = $1.00 stormwater utility fee per month). The SWU would then need to assess the average impervious surface area for a typical single-family residence to define the standard (ex: 1 ERU = 1,000 sq. ft. of impervious area). Once these two standards are estimated based on the SWU’s needs and service area, an initial estimated customer fee can be calculated for each parcel within the service area, as shown below.

$0.80 per month

$1.20 per month

ERU $2.00 per month

The third step is the development of the rate structure(s) and fees that will be utilized by the SWU. This step builds on the information from Step 2 above, but refines it to an in-depth analysis of parcel size with delineation of the property characteristics, such as impervious and pervious area that can be used for billing purposes and stakeholder engagement.

As noted in the Comprehensive Feasibility Study section, it is highly recommended to develop more than one rate structure in order to solicit feedback from stakeholders and other community members by demonstrating how each rate structure and Level of Service option will affect the fees for various types of property owners.

Guidance on four (4) rate structures utilized by existing SWUs are provided below in Rate Structures.

The fourth step involves the development of a credit program to allow customers to obtain partial fee reductions. The Act specifies that credits must be provided for three specific categories of stormwater management measures. Providing means by which customers may reduce their SWU fees encourages property owners to provide stormwater runoff reduction and treatment measures closer to the source of the area that generated the runoff, thus more closely mimicking the natural system. These credits also demonstrate that there is a connection between customers’ actions and their fees, similar, although a little more complicated, to how other utility fees can be reduced (e.g. using less electricity results in a lower electric bill).

Additional guidance is provided below in Stormwater Utility Credit Program

The fifth step is deciding on a billing system (as noted above) for the implementation phase of the fees and credits, as well as the billing schedule (e.g. annually, quarterly, monthly). The decision on whether the owner, or occupants if the property is rented, will be responsible for paying the fees will also need to be evaluated at this time as it will affect which billing systems will be appropriate. The SWU will need to consider the benefits and drawbacks of coordinating with an existing utility, municipal billing, or IT department within the jurisdiction(s) of the service area. Some existing SWUs have included the stormwater fee with existing local sewer or water bills. However, this assumes the SWU’s customers have sewer or water services provided by a local utility or authority. Another option is to include the stormwater fee with the existing property tax bills that are sent out annually by the municipalities. A potential drawback with this billing method is that it could perpetuate the misunderstanding that the fee is a ‘RAIN TAX’, which is not the case; and some customers in the SWU’s service area may be tax-exempt and not receive tax bills. Property tax bills are also normally addressed to the owners of properties, while utility bills may be addressed to either the owners or occupants, depending on the utility and the agreements between landlords and tenants. To simplify this issue as property owners do not usually change as often as tenants, the SWU may want to keep the addressee of the bill as the owners of the properties and allow the owners to distribute the costs as they choose. Alternatively, some SWUs have established their own separate billing systems. This provides more flexibility in billing and a higher level of accuracy with the customer base, but may incur more administrative costs than other options mentioned above.

However, although seemingly obvious, the owners or occupants shall not both be billed for the same SWU charges. Either the owner OR occupant can be charged for the entire property, or the charges can be divided between the owner and occupant, but the SWU shall not duplicate charges for the same parcel.

Table 1: Sample Billing Systems – Benefits & Drawbacks

| Billing system type: |

|

|

|

| Potential Billing schedule: |

|

|

|

| Potential Benefits: |

|

|

|

| Potential Drawbacks: |

|

|

|

Periodic follow-up reviews, which can also be referred to as the sixth step, involves re-assessments on a pre-determined schedule to determine if any changes are necessary to revise the rate structure, fees and/or credits, etc. after implementation. Revisions to the SWU’s rate structure, or fees or credits may be necessary to accommodate various changes in the SWU’s stormwater program, such as those resulting from changes to the level of service, or to update the relevant information and data, including the parcel characteristic information, used in the establishment of fees. Depending on the scope of the revisions to be made, the need to perform public outreach should be considered. In some instances, the revision process and outreach efforts may be specified in the language of the SWU ordinance.

Rate Structures

In collecting reasonable fees to recover the cost of stormwater management, those fees must be based on the fair and equitable approximations of stormwater runoff generated from the customers’ properties within their service area.

These fees, based on the fair and equitable approximation of stormwater runoff, are calculated from the rate structure.

Rate structures utilize characteristic property features commonly associated with stormwater runoff. By using these features, SWUs will establish a rate structure that uses a mathematical relationship to distribute the cost of the existing and any new services to the properties within the SWU’s service area.

These characteristic property features most commonly include the property size and amount of pervious and impervious area. However, other features that may be used in the more complex rate structures include, but are not limited to, intensity of development, land use and/or zoning designation, soil type, vegetation coverage and the relative slope of a given property.

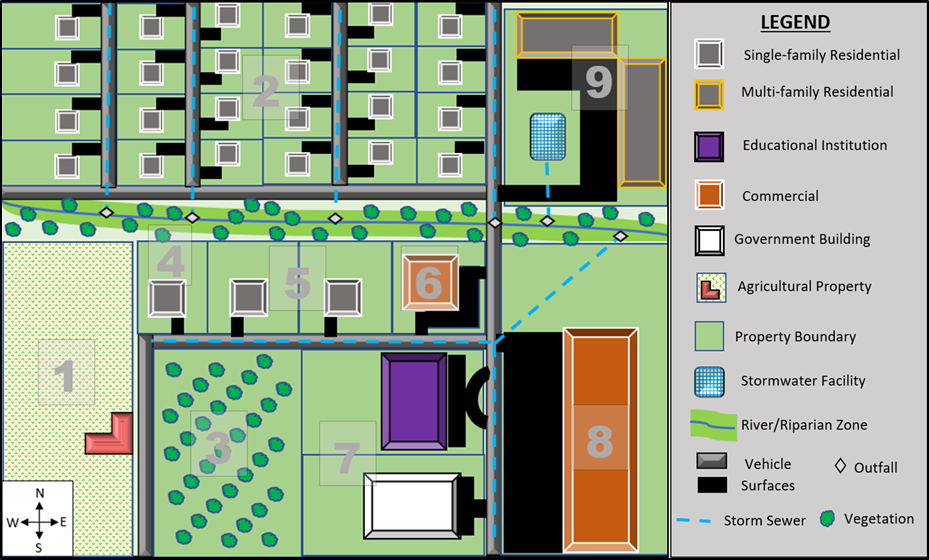

This section includes information on four common types of rate structures that have been used by existing SWUs, based on the WKU Stormwater Surveys and the 2009 USEPA fact sheet. Generic examples of the Tiered and ERU rate structures have also been developed using a fictional service area, described below in Figure 3 and Table 2.

- Tiered

- Equivalent Residential Unit (ERU)

- Equivalent Hydraulic Area (EHA)

- Residential Equivalency Factor (REF)

It should be noted that although these four types of rate structures are the most common, they are not the only four options. An SWU may choose to implement any type of rate structure, or combination thereof, they would like, as long as it is consistent with the Act, i.e. based on a fair and equitable approximation of stormwater runoff generated from the customers’ properties within the service area. For example, an SWU may implement one type of rate structure for residential properties and a different one for non-residential/commercial properties within the same service area. A tiered rate structure is fairly straightforward and may work well to determine fees for residential properties based on characteristics such as relatively similar property sizes and impervious areas, while an ERU rate structure that is based on the amount of impervious area on each individual non-residential/commercial property may be a more appropriate way to determine fees for those properties.

Additional information about the practices used by existing SWUs to develop these and other rate structures is available from a variety of sources, including other surveys, existing SWU’s rate structure analyses documentation, Environmental NGO publications and websites as well as other State and Federal guidance documents. The 2019 Western Kentucky Survey (https://digitalcommons.wku.edu/cgi/viewcontent.cgi?article=1000&context=seas_faculty_pubs) provides hundreds of examples of communities across the country that have implemented SWUs using various types of rate structures. Please see Appendix A of the survey for more information.

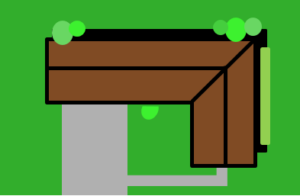

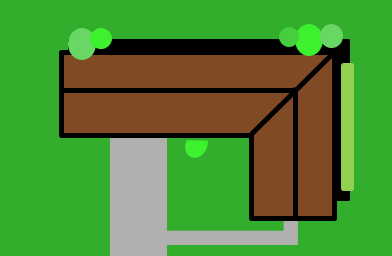

Figure 3 below depicts a fictional service area that is used as an example to highlight the different rate structures. The example presents different land types that can be found in a given service area; agriculture, single-family residential, undeveloped, commercial, public (including government and educational buildings), commercial, and multi-family residential. Table 2 details specific land-use characteristics that will need to be known for the properties prior to rate structure development. Each service area will be composed of several different land use types and may require the use of one or more rate structures to provide the most fair and equitable fee structure. The example service area has both residential zones and commercial zones with various parcel and impervious coverage sizes.

- Zone 1 depicts an agricultural land parcel, and it should be noted that the whole property including buildings and structures qualifies as exempt under the Farmland Assessment Act.

- Zones 2, 4 and 5 depict single-family residential properties with varying property sizes and impervious coverage.

- Zone 3 depicts an undeveloped land parcel.

- Zone 6, 7 and 8 depict commercial and public land parcels with various lot sizes and impervious coverage.

- Zone 9 depicts a multi-family residential property. The stormwater facility depicted in this zone may qualify the customer for a credit if it meets the criteria set forth in the Act and the rules and regulations set by the SWU. See the Credits section here for more information.

This fictional service area will be used in the examples below to illustrate the process to establish the Tiered rate structure and the Equivalent Residential Unit (ERU) rate structure.

Figure 3: Example service area (not drawn to scale). The pie charts provide details regarding

(1.a) the proportion of the land use types in the service area,

(1.b) the breakdown of total impervious area in the service area by land use type, and

(1.c) the customers in the service area by land use type.

*For this example, the entire agricultual property (including the barn) in Zone 1 has been granted Farmland Assessment.

Table 2: Characteristics of the example service area

|

Zone |

Class or type of property |

Number of properties |

Number of customers |

Individual property size (acres) |

Total zone size (acres) |

Individual property size |

Total zone size (sq. ft.) |

Individual property impervious area |

Total zone Impervious area |

|

|

1 |

Agriculture * |

1 |

0 |

6 |

6 |

261,360 |

261,360 |

3,000 |

3,000 |

|

|

2 |

Single-Family Residential |

24 |

24 |

5 |

0.25 |

6 |

10,890 |

261,360 |

1,950 |

54,500 |

|

9 |

2,200 |

|||||||||

|

7 |

2,450 |

|||||||||

|

3 |

2,600 |

|||||||||

|

3 |

Undeveloped |

1 |

1 |

2.25 |

2.25 |

98,010 |

98,010 |

0 |

0 |

|

|

4 |

Single-Family Residential |

1 |

1 |

0.5 |

0.5 |

21,780 |

21,780 |

4,000 |

4,000 |

|

|

5 |

Single-Family Residential |

2 |

2 |

0.625 |

1.25 |

27,225 |

54,450 |

4,000 |

8,000 |

|

|

6 |

Commercial |

1 |

1 |

0.625 |

0.625 |

27,225 |

27,225 |

21,000 |

21,000 |

|

|

7 |

**Public |

2 |

2 |

1.5 |

3 |

65,340 |

130,680 |

25,000 |

50,000 |

|

|

8 |

Commercial |

1 |

5 |

4 |

4 |

174,240 |

174,240 |

108,900 |

108,900 |

|

|

9 |

Multi-Family Residential |

1 |

40 |

2.5 |

2.5 |

108,900 |

108,900 |

45,000 |

45,000 |

|

|

Total |

|

34 |

76 |

|

26.125 |

|

1,138,005 |

|

294,400 |

|

| *For this example, the entire agricultural property (including the barn) in Zone 1, has been granted Farmland Assessment. **Public includes municipal buildings and educational institutions |

||||||||||

Tiered Rate Structure

The Tiered Rate Structure establishes groupings, or tiers, of similar properties based on shared characteristics, which may include but are not limited to; impervious area, property size, land use and municipal zoning. A uniform SWU fee is then applied to all property owners within each tier.

Demonstration of the Tiered Rate Structure:

The Department developed this example to demonstrate how the Tiered rate structure could be implemented based on the fictional service area depicted in Figure 1 and Table 2 above. It is assumed for this example that the annual expenditure of the SWU is $10,000, which is approximately $833.33 per month.

- The base rate of $25.25 is calculated by dividing the monthly expenditure of $833.33 by the number of eligible properties that can be billed, which is 33.

- Columns A and B show the minimum and maximum amounts of impervious area square footage that apply to each Tier. These minimum and maximum values will be determined by each SWU based on groupings of properties specific to their service area.

- Column C lists Base Rate Multipliers that would be chosen by the SWU as they develop the rate structure.

- Column D provides the cost per property per month and is calculated by multiplying the base rate ($25.25) by the base rate multiplier in Column C.

- Columns D and E are multiplied, and the results of the total monthly revenue generated per Tier are listed in Column F.

- Finally, to ensure that the total monthly and annual revenues meet the needs of the SWU, the total value for each Tier is added together for the monthly total, and then multiplied by 12 for the annual total, which are both shown at the bottom of the table.

The following is a simplified example of an equation used to determine the SWU fees for each tier of the Tiered Rate structure, where ‘IA’ stands for Impervious Area and ‘x’ refers to the square footage of the impervious area for any property in the service area.

SWU Fee (IA min < x < IAmax ; @ tier) = Base Rate * Base Rate Multiplier; @ tier

Table 3: Example rate structure and fee determination using the Tiered Method using a Base Rate of $25.25/month

|

Tiers |

Minimum Impervious Area(sq. ft.) (A) |

Maximum Impervious Area |

Base Rate Multiplier (C) |

Cost per property per month ($/month) (D) |

Number of Properties in each Tier (E) |

Total Revenue generated per Tier (F) |

|

1 |

0 |

1,000 |

0.1 |

2.53 |

1 |

2.53 |

|

2 |

1,001 |

2,000 |

0.2 |

5.05 |

5 |

25.25 |

|

3 |

2,001 |

3,000 |

0.3 |

7.58 |

19 |

143.93 |

|

4 |

3,001 |

10,000 |

0.4 |

10.10 |

3 |

30.30 |

|

5 |

10,001 |

30,000 |

3 |

75.76 |

3 |

227.77 |

|

6 |

30,001 |

70,000 |

5 |

126.25 |

1 |

126.25 |

|

7 |

7,0001 |

110,000 |

11 |

277.75 |

1 |

277.77 |

|

Monthly Total |

$833.30 |

|||||

|

Annual Total |

$9,999.60 |

|||||

*Note 1 – Due to rounding in this example to the hundredths place, or whole cents, for the base rate there is a projected deficit of $0.40 in the annual revenue.*

Table 3 above provides the breakdown of the number of properties that fall within each tier based on their impervious area and the total revenue that is generated per tier.

-

- The residential properties shown above in Figure 1 and Table 2 for Zone 2 consist of twenty-four (24) single family residential properties, which represents a model neighborhood with some variation in the amount of impervious area on the properties, shown as four groups.

- The five residential properties with the smallest impervious area are in Tier 2 and will pay $5.05 per month.

- The remaining nineteen residential properties have more impervious area and fall within Tier 3, where the stormwater fee is $7.58 per month.

- The residential properties shown above in Figure 1 and Table 2 for Zone 2 consist of twenty-four (24) single family residential properties, which represents a model neighborhood with some variation in the amount of impervious area on the properties, shown as four groups.

- Zones 4 and 5 include the three other single-family residential properties in this service area which fall within the impervious area range of Tier 4 that has a corresponding SWU fee of $10.10 per month.

- Since the multi-family residential property in Zone 9 has significantly more impervious area than the other residential properties, it belongs to Tier 6 with an SWU fee of $126.25 per month. However, there are forty (40) residential units on this multi-family residential property. As such, each owner or occupant would only pay 1/40th of the stormwater fee, or approximately $3.15 per month.

- The non-residential properties within this service area include the agricultural land in Zone 1, the undeveloped property in Zone 3, the commercial buildings in Zones 6 and 8, and the public buildings in Zone 7.

- The entire agricultural property in Zone 1, including the barn, is exempt from an SWU fee assessment because it was deemed to qualify under the Farmland Assessment Act, as noted above.

- The undeveloped property in Zone 3 would be assessed an SWU fee of $2.53 per month based on the impervious range established for Tier 1.

- The commercial property in Zone 6 is in Tier 5, which carries a fee of $75.76 per month.

- The public buildings in Zone 7 also belong to Tier 5 and would be assessed the same fee of $75.76 per month .

- The other property in Zone 8 represents a commercial shopping plaza and would belong to Tier 7 with the highest stormwater fee applicable at $277.75 per month. But since Table 5 identifies Zone 8 as having 5 customers on this property, the fee would be split among those businesses somehow, likely according to square footage of office space. Assuming equal office space for each of the 5 businesses, the fee would be $55.55 per business per month.

This is only one example of many SWUs that have chosen the Tiered rate Structure. As noted above, The 2019 Western Kentucky Survey (https://digitalcommons.wku.edu/cgi/viewcontent.cgi?article=1000&context=seas_faculty_pubs) provides hundreds of examples of communities across the country that have implemented SWUs using various types of rate structures. Please see Appendix A of the survey for more information.

The ERU is a standardized unit of measurement used by many SWUs which is defined as the average impervious area (e.g. square feet) for the residential properties (e.g. single-family residences, multi-family residences, apartments, condos, mobile homes, etc.) within the proposed service area.

*Although not illustrated in the example below, the Single-Family Residential Unit (SFRU) is a commonly used variant of the ERU, and is based on the average impervious area for ONLY the single-family residential properties within the service area.*

Typically, the ERU is calculated from a smaller representative sample of residential properties within the service area. To ensure an accurate representation of the service area, it is highly recommended that the sample of residential properties be selected from various locations within the SWU’s service area that correspond with different communities and housing styles, such as those from different time periods of local development.

Calculating an ERU based on a representative sample will take less time to develop and will be easier to maintain than calculating the ERU based on the impervious area from all of the residential properties within the service area.

However, a major consideration when determining the ERU is the accuracy and precision of the impervious area data. A fairly accurate assessment of the impervious area for the residential and non-residential properties is necessary for assessing a fee for this rate structure, or any others that use impervious area. Therefore, it is recommended to perform some follow-up field surveys to verify that the impervious area data is accurate and precise enough for the sample residential properties, prior to finalizing the SWU fees. Depending on the results of this survey, the SWU may need to update the remaining impervious area data to enhance its accuracy.

After a standard impervious area is calculated for one ERU, the total number of ERUs within the service area needs to be determined. This is calculated by dividing the total impervious area in the service area by the impervious area that was determined for one ERU. All properties are then assigned ‘X’ amount of ERUs based on the parcel’s impervious coverage. The base rate is then determined on a per ERU basis by dividing the anticipated SWU’s costs by the total number of ERUs in the service area.

The SWU fee would then be assessed for each property by multiplying the number of ERUs for each property by the base rate of one ERU.

Demonstration of the ERU Rate Structure:

The Department developed this example to demonstrate how the ERU rate structure could be implemented based on the fictional service area depicted in Figure 3 and Table 2. It is assumed for this example that the annual expenditure of the SWU is $10,000.00, which is approximately $833.33 per month.

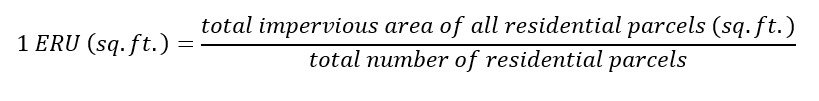

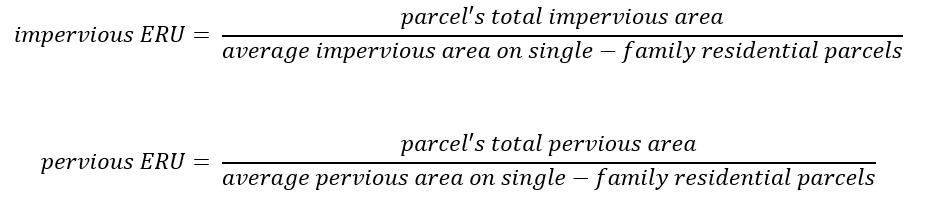

The following equations are used in the implementation of the ERU method in this example –

![]()

![]()

Then, to calculate the fee per parcel –

![]()

The average impervious area on the residential properties, or the ERU, was calculated using the information provided in Table 2 with the equations above. From this, the total number of ERUs in the service area was determined by dividing the total impervious area of the service area by the impervious area of one ERU. After which, the monthly base rate was established on a per ERU basis by dividing the monthly expenditures of the SWU by the total number of ERUs. From these values, the SWU fee per customer can be calculated and using the final equation above. Each customer’s fee will be dependent upon on the amount of impervious area, or ERUs, of their property.

Table 4: ERU and Base rate determination

| Annual Cost ($) | Monthly cost ($) | ERU = Average Residential impervious area (sq.ft.) | Total ERUs in service area | ERU monthly base rate ($/ERU) |

| $10,000.00 | $833.33 | 3,844.83 | 75.78 | $11.00 |

The breakdown of the SWU fee cost for the different zones and their corresponding properties is provided in Table 5 below. Of note:

- The entire agricultural property in Zone 1, including the barn, is exempt from an SWU fee assessment because it was deemed to qualify under the Farmland Assessment Act, as noted above.

- The twenty-four (24) single family homes in Zone 2 represent a small development, with some variation in the amount of impervious area on the properties. The properties with more impervious area have a higher ERU and are assessed a higher fee.

- While the multi-family property in Zone 9 has a stormwater fee of $128.70 per month, there are forty (40) residential units on this property. As such, each owner or occupant would only pay 1/40th of the stormwater fee, or approximately $3.22 per month.

- Similarly, the commercial property in Zone 8 represents a strip mall with 5 businesses. This property has the highest stormwater fee associated with its impervious area at $311.52 per month. However, that fee would be split among the 5 businesses for Zone 8, making it $62.30 per customer per month (assuming an even distribution of floor space).

The undeveloped land in Zone 3 would not have to pay an SWU fee under the ERU rate structure, since it contains no impervious area.

- The cost per property (Column C) can be calculated by multiplying Column B by the ERU monthly base rate of $11.00

- The total monthly fees (Column D) can be calculated by multiplying Column A by Column C

- Due to rounding, the annual total collected is $5.60 greater than the assumed annual expenditure of $10,000

Table 5: Breakdown of the costs using an ERU base rate of $11.00

|

Zone |

# of customer properties |

ERUs per property |

Cost per property ($) |

Total monthly fees ($) |

|

1 |

Property is not assessed a fee due to Farmland Assessment exemption |

|||

|

2 |

5 |

0.51 |

5.61 |

28.05 |

|

9 |

0.57 |

6.27 |

56.43 |

|

|

7 |

0.64 |

7.04 |

49.28 |

|

|

3 |

0.68 |

7.48 |

22.44 |

|

|

3 |

Property is not assessed a fee as land is undeveloped and contains no impervious area |

|||

|

4 |

1 |

1.04 |

11.44 |

11.44 |

|

5 |

2 |

1.04 |

11.44 |

22.88 |

|

6 |

1 |

5.46 |

60.06 |

60.06 |

|

7 |

2 |

6.50 |

71.50 |

143.00 |

|

8 |

1 |

28.32 |

311.52 |

311.52 |

|

9 |

1 |

11.70 |

128.70 |

128.70 |

|

Monthly Total |

$833.80 |

|||

|

Annual Total |

$10,005.60 |

|||

The EHA rate structure bills customers based on the combined impact of stormwater runoff from both impervious and pervious surface in any given parcel. Each SWU that uses this rate structure will need to calculate and set a fee per sq. ft. for impervious land and a fee per sq. ft. for pervious land. Additionally, this rate structure has the potential to be highly customized to accommodate certain characteristics of service areas, if desired, by including slope, land cover types, and other factors when determining the fees per sq. ft. of impervious and pervious land. Impervious area is typically charged at a much higher rate than pervious area and therefore each parcel requires a detailed analysis. Since this rate structure accounts for stormwater flow from impervious as well as pervious surfaces, it will consequently include undeveloped and vacant land parcels in the billing process.

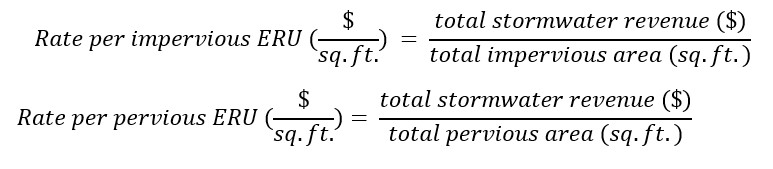

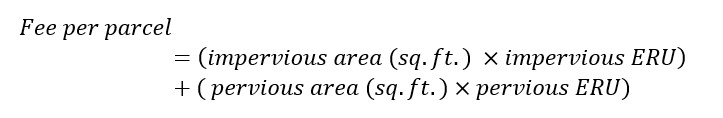

The following equations and information represent one way to calculate the fee per customer while following the EHA rate structure that have been taken from the example SWU (City of Monona, Wisconsin):

To determine a fee per sq. ft. of pervious and impervious surfaces, the City of Monona has established that the Equivalent Runoff Unit (ERU) is the ‘estimated impervious area of a parcel relative to the statistical average impervious area of a single-family unit residential property within the City, as determined from time to time by the Director.’ This ERU is NOT to be confused with the ERU rate structure described previously. While it is a similar concept, for this section, ERU will represent the Equivalent Runoff Unit used to calculate the fee per sq. ft. of pervious and impervious land in the City of Monona.

Note that if following the equation above, undeveloped land that has zero impervious area will have an impervious ERU equaling 0.

Once the ERU is established, the SWU will determine the rate per ERU which can be determined by comparing the total stormwater revenue needed to the total ERUs of both impervious and pervious cover in the service area.

And lastly, to determine the fee per land parcel/customer the above information will be combined in the following:

While the EHA rate structure provides the greatest opportunity to keep fees fair and equitable across the service area, it should be noted that this rate structure will also consume a considerable amount of resources from initial development to ongoing maintenance, and beyond. This rate structure is much more complicated to establish, as accurate information regarding the pervious and impervious areas of each property in the service area must be known before the SWU can determine any fees. This rate structure is also resource intensive to maintain as each improvement on each parcel in the service area will trigger a recalculation of the fee.

The Residential Equivalency Factor (REF) rate structure is developed based on the contribution of stormwater runoff volume by the various land uses within the service area. It takes a scientific approach to calculate a stormwater utility fee, and consequently is one of the most complex to implement due to the property characteristic information needed, which can include intensity of development, land use and/or zoning designation, soil type, vegetation coverage, and the relative slope of a given property.

The runoff from each land use type on each property is compared to the runoff generated from the reference single-family residential property to determine a ratio that is referred to as the Residential Equivalency Factor (REF). The City of Champlin, Minnesota is one example service area that implements this fee structure and will be used to discuss the process and implementation of this fee structure.

The first step of setting the REF for the service area will be to determine the annual budget needed for the SWU. The SWU will then need to determine which land use types exist in the service area (e.g. low density residential, medium density residential, high density residential, commercial/office, industrial, parks and open space, cemeteries, undeveloped/vacant, public/institutional and wildlife reserves). An in-depth study will need to be completed in order to determine the following for each land use type: estimated acreage, wetland acreage, number of parcels, estimated impervious surface, runoff volume, rainfall data, soil type, etc. This study will generate land use maps, volume charts for the chosen rainfall standard, and other extensive data sets for the service area to help determine the REF values.

To determine the existing land uses in the service area, the SWU may use GIS data layers, aerial photos and any other means deemed appropriate, including field surveys, etc. Typically, once a land use map is created it will result in the estimated parcels per land use type and the acreage for each land use type. It will then be necessary to choose a representative sample area for each land use type that has been fully developed. After delineating the representative sample areas, all impervious surfaces (buildings, motor vehicle surfaces, etc.) will need to be measured. These impervious surface measurements may also be conducted with the use of aerial photos along with digitizing the impervious surfaces through GIS. The percent of impervious surfaces within each land use can be calculated by dividing the area of impervious coverage by the total area of each land use sample. This percentage value can be used for the entire land use type. Example land use types and their corresponding impervious surface coverage measurements are summarized below from the example City of Champlin:

Table 6: Percent impervious for each land use type for the City of Champlin, MN

|

Land Use |

Percent Impervious |

|

Low Density Residential |

20% |

|

Medium Density Residential |

38% |

|

High Density Residential |

45% |

|

Commercial/Office |

64% |

|

Industrial |

62% |

|

Parks/Open Space/Undeveloped |

4% |

|

Public/Institutional |

30% |

|

Elm Creek Park Preserve/Wildlife Reserves |

0.5% |

The next step would be to determine the runoff volume for each land use type. The average annual runoff volumes for the chosen rainfall standard can be calculated using rainfall data for the service area. The SWU would need to choose the average standard runoff that will be used in their calculations. There are many organizations that collect and publish rainfall data. One example would be the National Oceanic and Atmospheric Administration’s (NOAA) National Weather Service (NWS). The NWS publishes and updates hydrological data including frequency of rainfall depth and intensity under normal operating conditions. Once accurate rainfall data is collected for the service area, the SWU will need to compute the runoff volume for each land use type using the equation provided by the USDA National Resource Conservation Service (NRCS) method for the chosen standard stormwater runoff volume. The potential for runoff (i.e. the runoff curve number [CN]) depends on the soil type and land use. The NRCS divides soil up into four hydrologic soil groups: A, B, C, and D (ranging from more water-absorbent sands (Type A) to less water-absorbent clays (Type D). The runoff curve numbers range from 0-100 in theory, but in practice range from 30-98. A curve number of 98 corresponds to parking lots and streets and 30 corresponds to bushy land in type A soil. The more hard surface a parcel has, the higher its curve number and the greater the runoff.

Each land use type will have a different pervious curve number dependent upon the soil type found in each land use area and therefore produce a different volume of stormwater runoff. It should be noted that other methods such as the modified rational method may be used in place of the NRCS method to calculate the stormwater runoff quantity. More information on pervious curve numbers and computing runoff volumes can be found in Chapter 5 of the New Jersey Stormwater Best Management Practices (BMP) Manual. Additionally, Chapter 12 of the BMP manual provides important information that will assist in identifying soil hydrologic groups necessary for selecting the appropriate curve numbers.

The runoff volumes for each land use type can be calculated by summing the pervious and impervious runoff volumes over one acre of land according to the measured impervious coverage for each land use. The REF is defined as the ratio of volume of runoff generated by one acre of land to the volume of runoff generated by one acre of low-density residential land. Therefore, a REF of 1.0 is given to one acre of single-family residential land use.

The SWU will need to analyze the service area to determine the average single-family residential parcel size as compared to 1 acre. For example, the example City of Champlin has an average single-family residential parcel of 14,520 sq. ft. or approximately three single-family residential parcels to one acre. Because the REF is based on the runoff generated by any given property, the same REF value may be used throughout the land use type.

The table below shows example REF values per one acre for all land use types based on the average annual runoff volume for each land use type for the example City of Champlin:

Table 7: REF values per acre of land use types in the City of Champlin, MN

|

Land Use |

REF per acre |

|

Low Density Residential |

1.0 |

|

Medium Density Residential |

1.7 |

|

High Density Residential |

2.0 |

|

Commercial/Office |

2.8 |

|

Industrial |

2.7 |

|

Parks/Open Space/Undeveloped |

0.27 |

|

Public/Institutional |

1.4 |

|

Elm Creek Park Reserve/Wildlife Reserves |

0.07 |

The SWU will then need to set a base rate that will be derived from the annual needed budget for the SWU and the area per REF. The City of Champlin’s City Council set the base rate at $7.50/acre per REF monthly. After calculating all the values above (land use acreage, REF for land use, and base rate), the SWU can then calculate the monthly charge per parcel using the formula below.

*Net acreage = Total Acreage of parcel – Wetland Acreage of parcel

Using this base rate, the charge for one low-density residential parcel with 1/3 acre will be $2.50 per month or $30.00 annually.

Using this equation to find the charge for a 2.25-acre parcel of commercial property that has a REF value of 2.8 will result in a total of $47.25 per month or $567.00 annually.

![]()

Table 8. Summary of Pros and Cons of the Four Rate Structures

|

|

Tiered |

Equivalent Residential Unit (ERU) |

Equivalent Hydraulic Area (EHA) |

Residential Equivalency Factor (REF) |

| Pros |

|

|

|

|

| Cons |

|

|

|

|

Table 9. Ease of Implementation of the Four Rate Structures

|

|

Tiered |

Equivalent Residential Unit (ERU) |

Equivalent Hydraulic Area (EHA) |

Residential Equivalency Factor (REF) |

|

Equity |

Fair |

Good |

Excellent |

Excellent |

|

Simplicity (for the public and decisionmakers to understand) |

Excellent |

Excellent |

Fair/Poor |

Poor |

|

Ease of Data Collection |

Good/Excellent |

Fair |

Poor |

Fair/Poor |

|

Cost and Ease of Administration Needs |

Fair/Good |

Fair/Good |

Fair/Poor |

Poor |

In addition to what the SWU may collect as reasonable fees, the SWU may also apply for additional funding/financing from the New Jersey Water Bank and Water Quality Restoration Grants for Nonpoint Source Pollution for various stormwater projects, including those related to combined sewer overflows. Further information regarding these financing opportunities is available at https://www.nj.gov/dep/dwq/mface.htm and NJDEP-Division of Water Monitoring and Standards , respectively.

In 2006, NAFSMA created a document entitled, Guidance for Municipal Stormwater Funding.This guidance provides a resource to local governments as they address contemporary stormwater program financing challenges. While the guidance examines a range of possible approaches to paying for stormwater management, the focus is mainly on guidelines for developing service/user/utility fees to support stormwater programs, and includes procedural, legal, and financial considerations in developing viable funding approaches.

Also, in March 2020, the Environmental Financial Advisory Board (EFAB) submitted their report, Evaluating Stormwater Infrastructure Funding and Financing, to the USEPA, which can be found on the home page for the Water Infrastructure and Resiliency Finance Center. This report evaluates stormwater infrastructure funding and financing, and was developed by an EFAB Task Force in response to Section 4101 of the 2018 America’s Water Infrastructure Act (AWIA).

The Act specifies that partial fee reductions in the form of credits be established by the SWUs. These credits will provide an opportunity and an incentive for property owners to reduce their SWU fees by managing their stormwater on their own property. However, the credits awarded to any property owner should not reduce the entire cost of the fee.

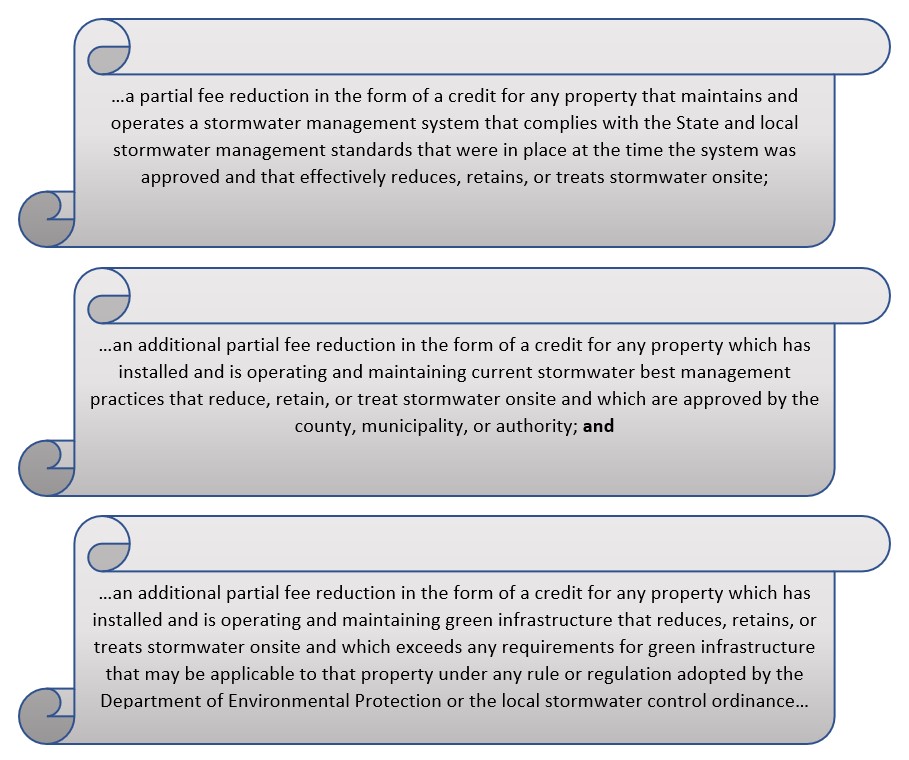

The Act requires that any county, municipality or authority that forms an SWU that collects fees and other charges, provide for, at a minimum, the following three types of credits:

In summary, the SWU must implement a credit program that provides, at a minimum;

- a credit for properties where the customer is properly operating and maintaining older, approved onsite stormwater management systems as they were designed that effectively reduce, retain, or treat stormwater;

- an additional partial credit for properly operating and maintaining approved onsite stormwater management systems (BMPs) as they were designed in accordance with current requirements that reduce, retain, or treat stormwater; and

- an additional partial credit for properly operating and maintaining approved onsite green infrastructure as it was designed, which also exceeds current regulatory requirements for green infrastructure requirements that reduce, retain, or treat stormwater onsite.

In order for a property to qualify for one of these stormwater credits, it must be noted that the Act specifically requires that the stormwater management measure(s) be operated and maintained properly. It will be the responsibility of the SWU to ensure that this maintenance has and continues to occur in accordance with any applicable rules or permits. For example, the MS4 permits require the municipalities to ensure that all public and private stormwater management measures are maintained properly. The permit also requires the permittees to comply with the Stormwater Management rules at N.J.A.C. 7:8 . These rules require that when stormwater management measures, or best management practices (BMPs), are installed as a result of requirements for a major development or redevelopment, the developer is required to prepare and submit a complete maintenance plan for each BMP with the application to the approving authority prior to approval.

The Department’s BMP Manual provides additional guidance on the proper installation, operation, and maintenance of many stormwater management measures and this BMP Manual is periodically updated to reflect the amendments made to the Stormwater Management rules. Additional guidance on stormwater management facility maintenance, including educational resources, sample maintenance plans and field manuals for specific BMPs, is provided through the following link: https://www.njstormwater.org/maintenance_guidance.htm

Details of the credit program will likely be influenced by local stormwater management priorities and through feedback that is solicited from the stakeholders and the public. A more detailed discussion on public education and outreach can be found on the “Establishing a Stormwater Utility” tab under the “Engage Stakeholders” and “Engage Public” accordion sections. The SWU will need to provide the credit program information on their website, with specific information explaining what applicants will need in order to qualify for any credits, and how they will need to submit that information to the SWU.

The following are just a few common factors that an SWU should take into consideration when developing a credit program:

-

- What is the maximum amount of credit each stormwater management measure, or Best Management Practice (BMP), will be worth?

- How much of the credit will be based on the volume of stormwater runoff reduced?

- How much of the credit will be based on the reduction of pollution in the stormwater runoff?

- Will the credits be for a set amount of money, or a percentage of their fee?

- What is the maximum amount of credit that an individual property can obtain, either as a dollar amount or percentage?

- How will a property owner or occupant apply for credits?

- What level of verification will be necessary to obtain credits?

- How often will customers need to re-verify their qualifications for the credits?