The upfront costs of zero-emission vehicles, charging equipment, and electric infrastructure upgrades can be a significant barrier to electrifying your fleet. To help promote cost parity with traditional internal combustion engine vehicles, federal and state governments, as well as utility companies, provide funding and incentive opportunities. A summary of current incentive programs in New Jersey is summarized below. Note that while each organization may be eligible for multiple programs, there may be restrictions on which programs can be stacked together for the same vehicles or equipment. Typically, state and federal incentive programs can be stacked with tax credits and utility make-ready programs, but not other incentive programs. While this website will be updated periodically, please see each program’s website for the most up to date information and requirements.

Federal Tax Credits

The Federal Government offers two major tax credits to support organizations in acquiring zero-emission vehicles for their fleets. These credits are administered by the Internal Revenue Service (IRS) and require completing tax forms at the time of filing. Read below to learn how to claim these credits.

Commercial Clean Vehicle Tax Credit

The Federal Government’s adoption of the Inflation Reduction Act (IRA) enacted new federal tax credits (IRC Section 45W) for commercial electric or hydrogen fuel cell vehicles in 2022. Eligible entities include businesses and tax-exempt organizations that purchase commercial clean vehicles between January 1, 2023 and January 1, 2033. Heavy-duty vehicles with a GWVR of 14,000 lbs or greater are eligible for a tax credit of $40,000, or 30% of the incremental cost of the vehicle as compared to a gasoline or diesel vehicle, whichever is lower. Applicable electric vehicles must have a battery with ≥15kWh of capacity and be made by a qualified manufacturer.

Claiming the Credit:

- Partnerships and S corporations must file Form 8936, Qualified Plug-in Electric Drive Motor Vehicle Credit;

- All other eligible taxpayers do not need to complete Form 8936 if their only source for the credit is a partnership or S corporation and instead can report this credit directly on line 1aa in Part III of Form 3800, General Business Credit.

Alternative Fuel Infrastructure Tax Credit

Beginning on January 1, 2023, installation of electrical charging equipment in certain eligible census tracts is eligible for a tax credit of 30% of the installation costs (or 6% in the case of property subject to depreciation), with a maximum credit of $100,000. Permitting and inspection fees are not included in covered expenses. Tax-exempt entities are eligible to claim credits through a direct payment from the IRS after filling out tax form 8911. Details of this are also pending guidance from the federal government.

You can determine whether you are in an eligible tract at the 30C Tax Credit Eligibility Locator (arcgis.com). Users may input an address or latitude/longitude coordinates in the search bar.

State Incentives

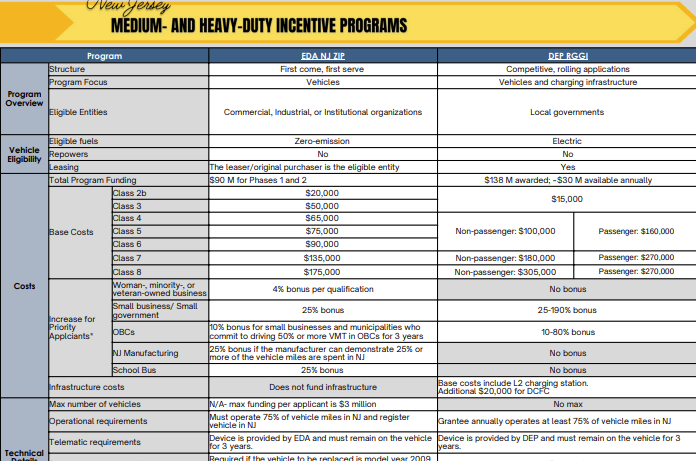

New Jersey offers a number of funding and incentive opportunities for zero-emission vehicles and charging equipment. State incentives are summarized in the below table and discussed further in this section. To stay up to date with future transportation program announcements and updates, subscribe to DEP, BPU, and EDA’s email lists.

Some state incentives prioritize or offer an additional incentive for being located in an overburdened community. You can look up your address on the EJMAP to check your status.

Utility Incentives

Utility companies in New Jersey have a variety of offerings to incentivize the transition to zero-emission vehicles. To view a full list of utilities in New Jersey and their incentive programs, visit the Alternative Fuels Data Center U-Finder. The map below illustrates the territories of the major utilities in New Jersey:

There are several common types of utility incentives:

Make-Ready Programs

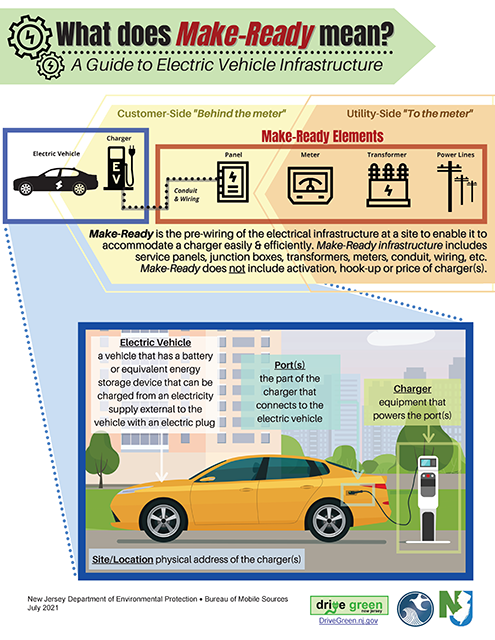

Make-Ready refers to preparing electric utility infrastructure to easily accommodate EV chargers. Under Make-Ready Programs utility companies cover some or all of the infrastructure upgrade or equipment costs that the fleet would typically pay for when installing EV chargers. Make-Ready programs vary in what is covered among front-of-meter and behind-the-meter costs, though “behind the meter” costs are typically covered by the customer.

Currently, Jersey Central Power and Light (JCP&L), PSE&G, and ACE offer EV Make-Ready programs. Visit their websites for specific details on each.

The diagram below illustrates these different costs that utilities may cover in Make-Ready Programs:

Rebates

Similar to Make-Ready programs, utilities cover some or all of the installation or charging equipment costs through rebates after the point of purchase. Currently, Atlantic City Electric and Public Service Electric and Gas offer rebates for commercial businesses. Visit their websites for specific details on each.

Time-of-Use (TOU) Rates

Some utilities offer TOU or specific electric vehicle rates to incentivize EV owners to charge during off-peak hours by offering reduced energy prices during these times. Utilities may offer other special rates to incentivize specific actions, such as a reduced rate for allowing your charger to be accessed by the public.

Fleet Assessment

Utilities may offer fleet assessment services to help prepare fleets for EV charging. Orange and Rockland currently offers fleet assessment services to government and public fleets. New Jersey Fleet Advisor offers fleet assessment services for public, private, and nonprofit businesses.

OFFICIAL SITE OF THE STATE OF NEW JERSEY

OFFICIAL SITE OF THE STATE OF NEW JERSEY