Incentives to Drive Green

There are valuable state, federal, and utility incentives to make the transition to electric easier.

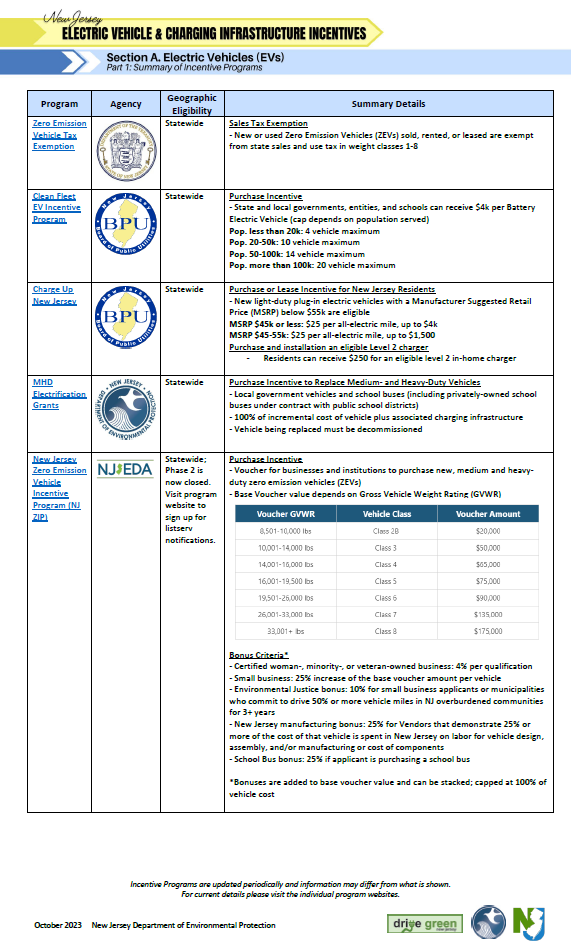

State Incentives

Receive an incentive of up to $2,000 when you purchase or lease a new all-electric vehicle in New Jersey.

Receive a rebate of up to $250 when you purchase an eligible electric vehicle charger for your home. This incentive can be combined with utility incentives for installation of a home charger.

Zero Emission Vehicles are exempt from the NJ state sales tax, so you’ll save 6.625% on the sale, lease or rental of a new or used battery electric vehicle (also known as all-electric vehicle) in weight classes 1-8. This exemption does not apply to plug-in hybrid electric vehicles. This exemption will begin to phase out on 10/1/2024.

Grants to offset the cost to purchase electric vehicle charging stations. Eligible locations include public parking lots and garages, apartments and condominiums, workplaces, hotels, retail, downtown areas, rest stops, and more. These grants can be combined with utility incentives for installation of charging stations.

Grants for electric shared mobility project such as electric car sharing and ride hailing. Projects that benefit low- or moderate-income communities that are disproportionately impacted by air pollution will be prioritized.

Grants to replace old diesel trucks, buses, port equipment, marine vessels, and trains with electric power and to offset the cost of associated charging infrastructure.

Vouchers towards purchasing new, zero-emission medium-duty and heavy-duty vehicles vehicles that will operate in New Jersey. Eligible entities include micro- and small businesses and institutions to reduce emissions in overburdened communities.

Locations ranging from boardwalks, parks, and other unique attractions, as well as overnight lodging, establishments can apply for grants for Level 2 charging stations and DC Fast Charging stations.

Designed to encourage owners and operators of MUDs to provide EV chargers for residents and guests, the program offers incentives to support the purchase and installation of eligible Level 2 EV charging equipment.

NJDEP and NJBPU have grant programs available for multi-unit dwellings. See the document below for a comparison of the programs.

Grants to help state and local governments transition to electrically fueled fleets. Eligible applicants can receive grants toward the purchase of battery electric vehicles, public Level 2 charging stations, and fleet Level 2 charging stations.

Eligible entities include local schools, municipal commissions, state agencies or boards, state commissions, state universities, community colleges, county government, and county authorities, in addition to municipalities, municipal utility authorities, and state agencies.

Electric vehicles are qualified to receive reduced toll rates via the Green Pass Discount through their EZ Pass accounts: 10% discount on the off-peak rate for the New Jersey Turnpike and Garden State Parkway. Customers must enroll in the plan and provide proof of eligibility. To apply, call New Jersey E-ZPass at 1-888-AUTOTOLL (1-888-288-6865)

High-occupancy vehicle lanes, or HOV lanes, are located on sections of the New Jersey Turnpike and are set aside during peak travel times for vehicles carrying three or more people. Electric vehicles can drive in the HOV lanes, regardless of the number of passengers in the vehicle. Click the link for details and restrictions.

Summary of all current New Jersey electric vehicle incentives and funding opportunities, plus relevant laws, regulations, and other initiatives related to alternative fuels and vehicles, advanced technologies, or air quality.

Federal Incentives

The Inflation Reduction Act changed a wide range of tax laws and provided funds to improve services and technology to make tax filing easier. Since the Inflation Reduction Act is a 10-year plan, the changes won’t happen immediately. One provision changes the eligibility rules to claim a tax credit for clean vehicles. This took effect as soon as the law was signed. More details about clean vehicles and other tax provisions will be available.

EV Tax Credit Changes for 2023

The Inflation Reduction Act (IRA) provided for a Clean Vehicle Tax Credit to provide for investment in clean energy and transportation technology. Changes to the tax credit mean that new clean vehicles are eligible for up to $7,500 depending on battery size, and previously owned vehicles are eligible for up to $4,000. Some of the requirements include: the vehicle must be made by a qualified manufacturer, have final assembly in North America, and income limits do apply to taxpayers. Please visit these websites for more information.

Beginning January 1, 2023, fueling equipment for natural gas, propane, hydrogen, electricity, E85, or diesel fuel blends containing a minimum of 20% biodiesel, is eligible for a tax credit of 30% of the cost or 6% in the case of property subject to depreciation, not to exceed $100,000. Permitting and inspection fees are not included in covered expenses.

This tax credit can be stacked with the It Pays to Plug In grant program.

If your home or business has an electric vehicle charging station that is in use, or if it is equipped to supply fuel for alternative fuel vehicles, you may be eligible for a federal income tax credit.

Individuals who purchased an eligible fuel cell vehicle may be entitled to this federal income tax credit if they meet all of the requirements.

Utility Incentives

Ask your electric utility about incentives for charging station installation and EV-friendly electric rates to lower your bill. Please check your utility’s requirements before purchasing EV charging equipment, as there may be additional conditions on types of eligible chargers.

Atlantic City Electric EVsmart Program

Jersey Central Power & Light EV Driven Program

EV and EVSE Incentive Programs

The EV and EVSE Incentive Program Summary identifies the EV and EVSE programs in New Jersey and lists their incentive details. This Summary also charts the type of vehicles and applicants that are allowed by each program.