Inflation Reduction Act

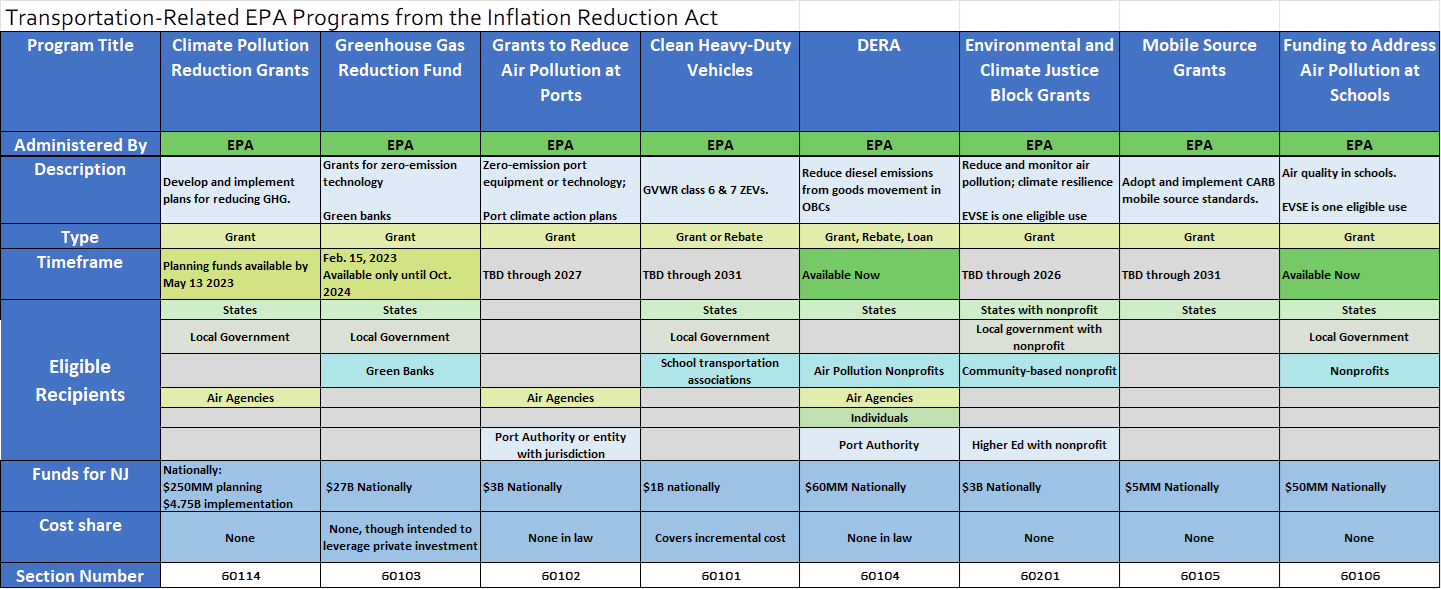

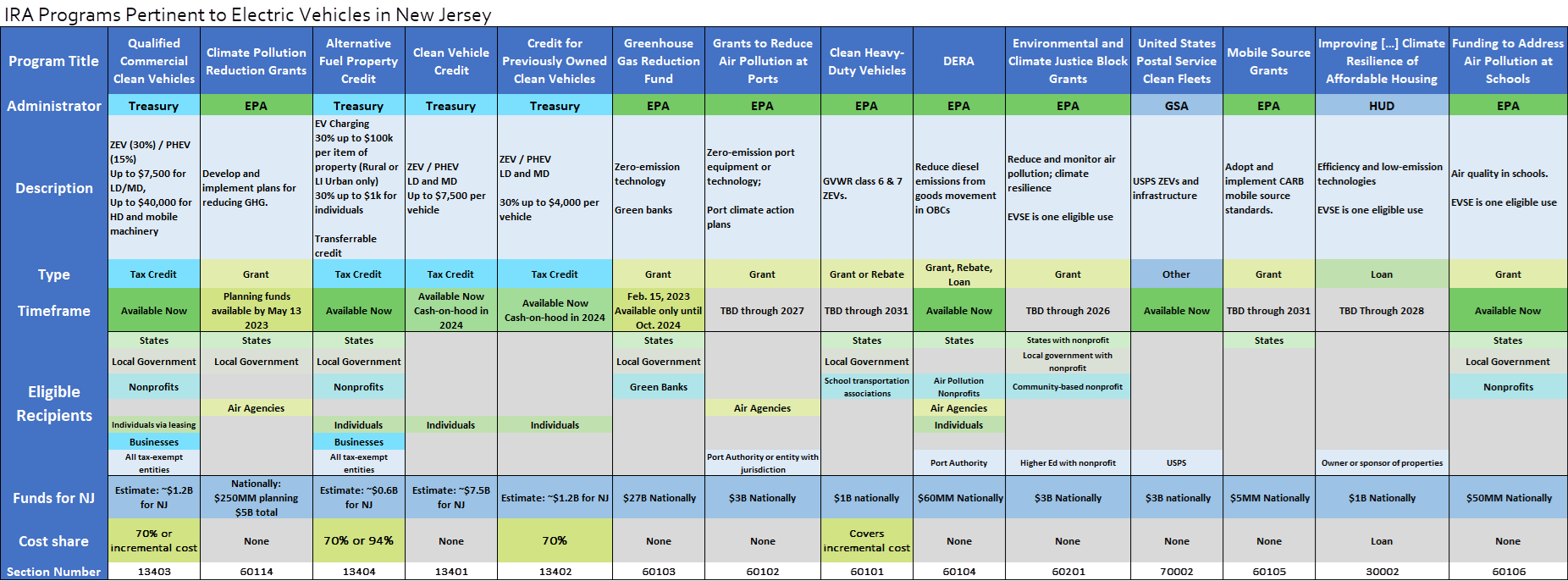

The Inflation Reduction Act changed a wide range of tax laws and provided funds to improve services and technology to make tax filing easier. Since the Inflation Reduction Act is a 10-year plan, the changes won’t happen immediately. One provision changes the eligibility rules to claim a tax credit for clean vehicles. This took effect as soon as the law was signed. More details about clean vehicles and other tax provisions will be available, please check these links for updates.

Inflation Reduction Act Overview

Inflation Reduction Act Guidebook

Credits and Deductions Under the Inflation Reduction Act of 2022

EPA’s new Environmental and Climate Justice Community Change Grants program is now open!

This funding is designed to deliver on the transformative potential of the Inflation Reduction Act for communities most adversely and disproportionately impacted by climate change, legacy pollution, and historical disinvestments.

Notice of Funding Opportunity

Information on how to apply this opportunity for electric, shared mobility in your community